Buying your first home is exciting—it’s a milestone that marks independence, stability, and the start of a new chapter.

But let’s be honest: it can also feel overwhelming.

With so many decisions to make and details to juggle, it’s easy to stumble into a few common pitfalls. Don’t worry, though. Today, we’re breaking down the 11 most common mistakes first-time homebuyers make—and how you can avoid them.

1. Shopping for homes before getting pre-approved for a mortgage. Solution: Start with a pre-approval. It shows sellers you’re serious and helps you set a realistic budget.

2. Falling in love with a home but ignoring the area. Solution: Research schools, commute times, and amenities. The right neighborhood can make or break your experience.

3. Using all your cash for a down payment. Solution: Keep a cushion for closing costs, moving expenses, and emergencies. You don’t want to become “house poor.”

4. Skipping the inspection to speed up the process. Solution: Always get an inspection. It’s your best protection against hidden issues that could cost you big later.

5. Overlooking additional costs and budgeting only for the mortgage. Solution: Factor in taxes, insurance, maintenance, and utilities. Owning a home costs more than the monthly payment.

6. Letting emotions take over, falling in love with a home, and overpaying to get it. Solution: Stick to your budget and keep emotions in check. There’s always another great home out there.

7. Ignoring resale value and buying a home without thinking about future buyers. Solution: Choose a property with broad appeal—good layout, solid construction, and a desirable location.

8. Taking out loans or switching jobs after you’ve applied for a mortgage. Solution: Keep your finances stable until you have the keys in hand. Your lender will thank you.

9. Not asking enough questions or feeling embarrassed to ask for clarification. Solution: Don’t be shy! Your real estate agent and lender are there to guide you. No question is too small.

10. Waiting for the “Perfect” time, or waiting for prices to drop. Solution: The best time to buy is when you’re ready financially and emotionally. Waiting can cost you in the long run.

11. Not calling or meeting with Darren first. Solution: Have a chat directly with Darren and get the best advice for your situation.

Click The Link Above

By steering clear of these common pitfalls and partnering with the right professionals, you can enjoy a smooth, stress-free journey. When you’re ready to take the next step, let’s connect. Together, we’ll find the perfect home for you—without the hassle. Your dream home is closer than you think!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

5. Refresh the Walls and Floors – A fresh coat of neutral paint can transform a space, making it feel clean, modern, and ready for new owners. Stick with soft grays, warm beiges, or creamy whites—buyers love a blank slate. Floors are another area where small updates can make a big difference. Refinish hardwood, replace worn-out carpet, or add luxury vinyl planks for a polished, contemporary look.

5. Refresh the Walls and Floors – A fresh coat of neutral paint can transform a space, making it feel clean, modern, and ready for new owners. Stick with soft grays, warm beiges, or creamy whites—buyers love a blank slate. Floors are another area where small updates can make a big difference. Refinish hardwood, replace worn-out carpet, or add luxury vinyl planks for a polished, contemporary look.

The best goals are specific, actionable, and have a clear timeline. Whether you’re buying, selling, or improving, 2025 is your year to dream big and make it real. Not sure where to start? That’s where I come in. Let’s turn your homeownership dreams into plans—and your plans into reality.

The best goals are specific, actionable, and have a clear timeline. Whether you’re buying, selling, or improving, 2025 is your year to dream big and make it real. Not sure where to start? That’s where I come in. Let’s turn your homeownership dreams into plans—and your plans into reality.

I’ve noticed that for this year, several of my clients have a new house at the top of their list for New Year’s Resolutions. Why? Because the market is starting to shift right now and for many, if they don’t make the move now, they may need to commit to another 8 years in their current residence. As is customary, we tend to see 4 or 5 years of lowering prices, followed by 4 or 5 years of recovery to get back to where we were to begin with. Right now, we appear to be at or just past the PEAK in home values.

I’ve noticed that for this year, several of my clients have a new house at the top of their list for New Year’s Resolutions. Why? Because the market is starting to shift right now and for many, if they don’t make the move now, they may need to commit to another 8 years in their current residence. As is customary, we tend to see 4 or 5 years of lowering prices, followed by 4 or 5 years of recovery to get back to where we were to begin with. Right now, we appear to be at or just past the PEAK in home values.

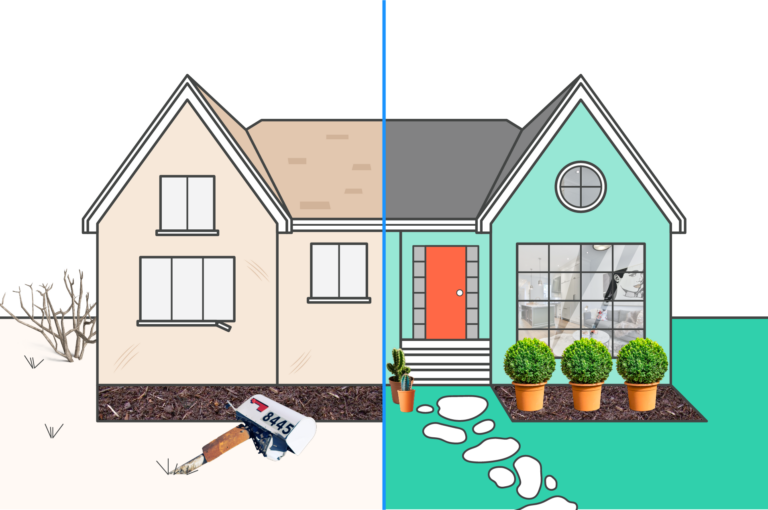

Most people want to shy away from selling their homes in the winter, whether it be from the cold, the holiday craziness, or because they simply think that their home won’t sell for enough money. Although, winter may not be the most popular time to sell a home, this does not mean you need to wait for it to warm up to list your property. With some hard work and a good strategy, you can make your home stand out to potential buyers.

Most people want to shy away from selling their homes in the winter, whether it be from the cold, the holiday craziness, or because they simply think that their home won’t sell for enough money. Although, winter may not be the most popular time to sell a home, this does not mean you need to wait for it to warm up to list your property. With some hard work and a good strategy, you can make your home stand out to potential buyers.

st forgotten ingredients, start now by making thorough lists. Write out the names of those you want to acknowledge during the holidays and why—figuring out what you really appreciate about someone can make gift buying easier.

st forgotten ingredients, start now by making thorough lists. Write out the names of those you want to acknowledge during the holidays and why—figuring out what you really appreciate about someone can make gift buying easier.

It’s a mistake to believe that real estate is always going up or that your home will be worth more money in two years than it is right now. As a matter of fact, as of today’s date, you are nearly guaranteed to have a home worth LESS money in two years than it’s worth today.

It’s a mistake to believe that real estate is always going up or that your home will be worth more money in two years than it is right now. As a matter of fact, as of today’s date, you are nearly guaranteed to have a home worth LESS money in two years than it’s worth today.

n credit to real estate for a large percentage of their empire. It seems that every time you read an article about a multi-millionaire, they’ll talk about how they started with just one or two rental properties and leveraged off of that to generate a huge portfolio of properties and millions of dollars. I’m sure you’ve seen those articles yourself.

n credit to real estate for a large percentage of their empire. It seems that every time you read an article about a multi-millionaire, they’ll talk about how they started with just one or two rental properties and leveraged off of that to generate a huge portfolio of properties and millions of dollars. I’m sure you’ve seen those articles yourself.

One of the biggest common misconceptions when it comes to your home is that all improvements will give you the value back and then some.

One of the biggest common misconceptions when it comes to your home is that all improvements will give you the value back and then some. The same is usually true for countertops, window repairs, punch-out items and many other minor issues. That’s why we often recommend a pre-market home inspection so you can knock out any minor issues to avoid scaring off the buyer when they have their inspections done.

The same is usually true for countertops, window repairs, punch-out items and many other minor issues. That’s why we often recommend a pre-market home inspection so you can knock out any minor issues to avoid scaring off the buyer when they have their inspections done.