Spring has finally sprung and you are undoubtedly seeing more and more neighbors milling around the community. The nice weather allows for afternoon walks to be more enjoyable and it’s a great chance to say hello to some of the fellow homeowners!

With all the blooming flowers, we also see several “For Sale” signs going up all over town. While you may be planning to stay in your home for the next several years, it’s still wise to keep your eyes peeled for new properties that pop on the market so you can get an idea as to what’s going on with current home values.

One common misconception that a lot of people have is that real estate values will always go up based on however long you hold it.

I often hear from clients that believe if they can’t get what they want for the total sale price of their home, they’ll just wait a couple of years until they can get that amount. This can prove to be disastrous. There are countless stories of homeowners that didn’t time the market correctly so they ended up selling their home for over $100,000 LESS than they could’ve gotten if they’d sold at a different time.

Another big misconception is that if the market slows and someone can’t get what they want for their home, they can just wait it out. Unfortunately, this generally doesn’t work out. As an example, during the last cycle, the home values peaked in 2008. So during 2009 and 2010 there were several homeowners that said “they’ll just wait a few years” to sell their home.

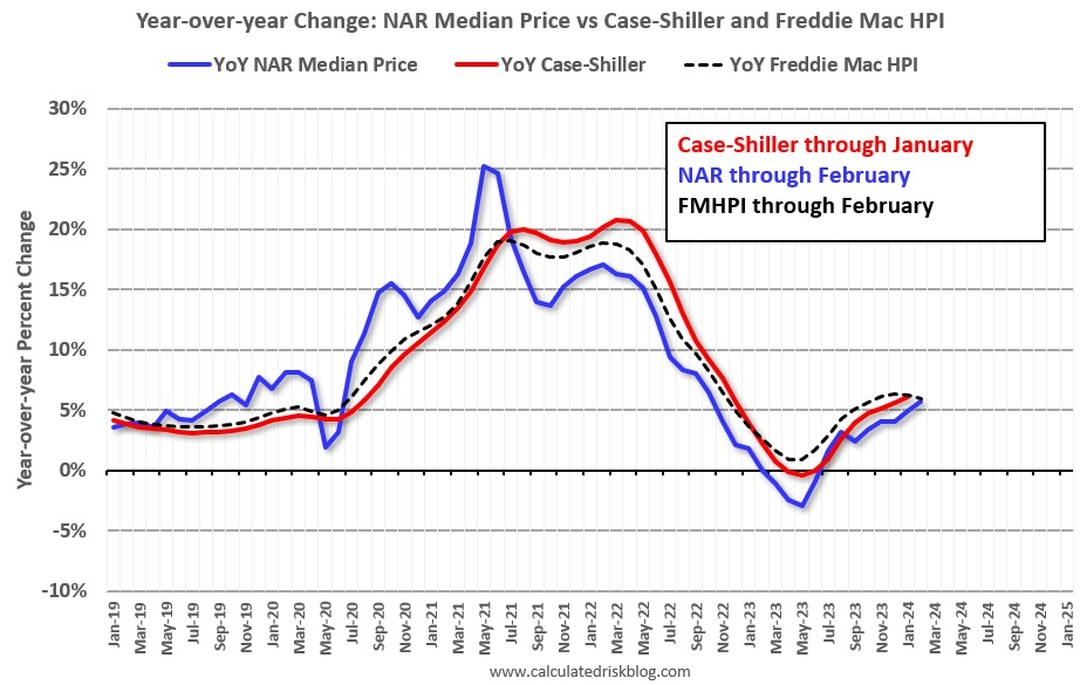

Over the last several decades, our cycles are often 5 to 7 years of dropping values, followed by 5 to 7 years of increasing values. So home values continuously dropped from 2008 to 2012 but then started to INCREASE in value beginning in mid-2012. That’s of no use for the owners though because it took a full 4 years to get BACK to where they were in 2008. So the value in 2008 was finally reached again in 2016 to be at a break-even point but is certainly a lot less money due to inflation over the course of those 8 years.

So be cautious in thinking you can wait a few years because statistics show that it may be 8 to 10 years before you get back to the current value you weren’t happy with in the first place!

While most of our real estate clients are happy staying right where they are for years and years (sometimes decades) it’s also wise to stay up on current values, pricing trends and the overall strength of the real estate market.

Just like owning any asset, even if you aren’t planning to sell it, you’ll want to keep up on the total value. As an example, if you own stocks, you may plan to own that portfolio forever but should still stay up on what’s going on, how the companies are being ran and anything going on within the economy that may change your thought process.

Sometimes owning a large asset is not all about how it fits you currently from a personal perspective as outside forces can mean it’s time to make some changes. That may mean refinancing, moving, doing additions to the place or any other combination of changes that may mean a better return on your investment. If I can help you with any questions, don’t hesitate to reach out. Consultations are always free!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link