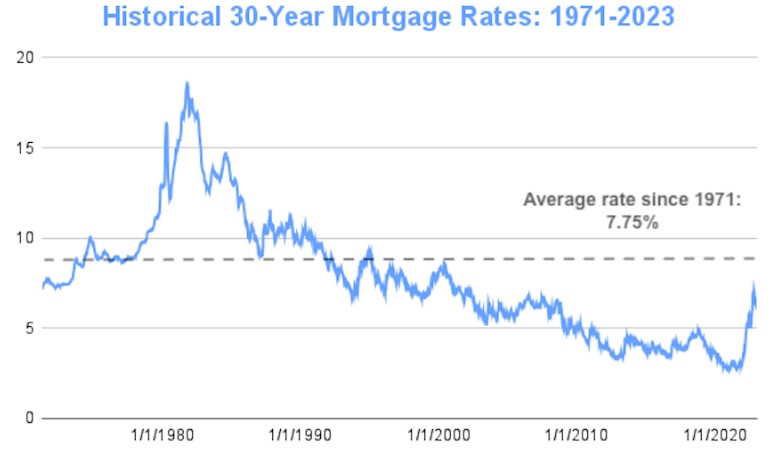

You’ve probably seen that interest rates are starting to slowly creep higher and higher. This can be a financial disaster for you if you are thinking you may want to sell your home in the next 2 to 8 years.

There’s no question that you can sell your current house for more money and buy a BIGGER house with an affordable payment now while the interest rates creep. But as they begin creeping up, it makes housing prices less and less affordable, ultimately pricing some people out of the market.

Since all mortgage qualifications are based on a monthly payment, the amount that you can afford each month will simply give you less buying power. As an example, if you can afford a $400,000 house today, that same monthly payment may only get you a $350,000 house if you wait to buy for another year or two. This is assuming that the interest rates will continue inching up as they have been for the past several months and as they are projecting.

As your real estate advisor, I owe it to you to make sure you know the importance of “forward thinking” when it comes to your housing needs. While every situation is different, the truth is that you know your family housing needs better than anyone. You can make a knowledgeable decision as to what changes may need to be made over the next 2 to 8 years. If you would anticipate a move up or a move down to another house, NOW may be the best time to do it from a financial perspective.

I’m sure you’ve always heard that the real estate market is all about TIMING. So it’s wise to think about any changes you may have in finances or family size over the next several years, then focus on the timing that will make the most sense financially.

I can help you with all real estate related questions with a free, no obligation phone consultation. You’ll never get a “sales pitch” and will receive sound, solid advice on some options that you may want to consider. Just call, text or email!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link